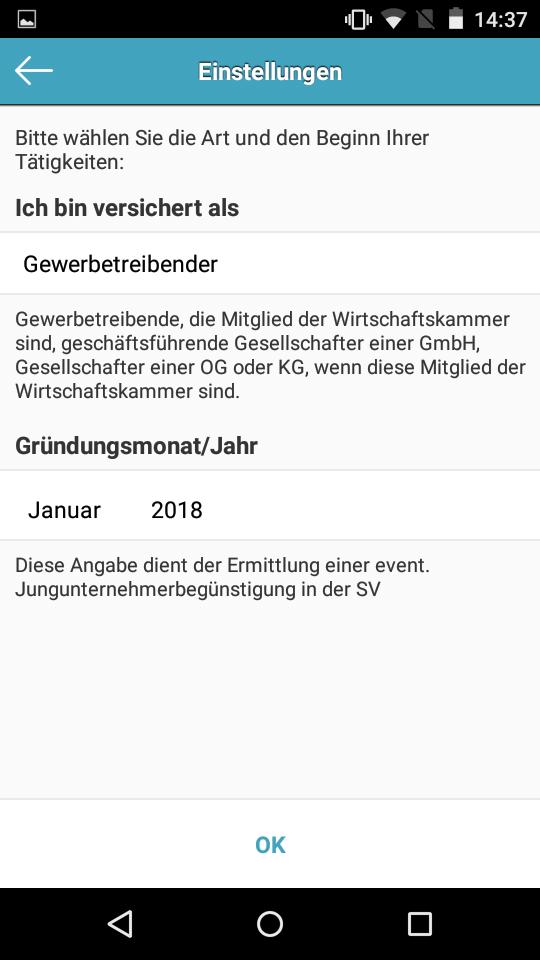

SV and Tax Calculator Determines The Social Security and Income Tax

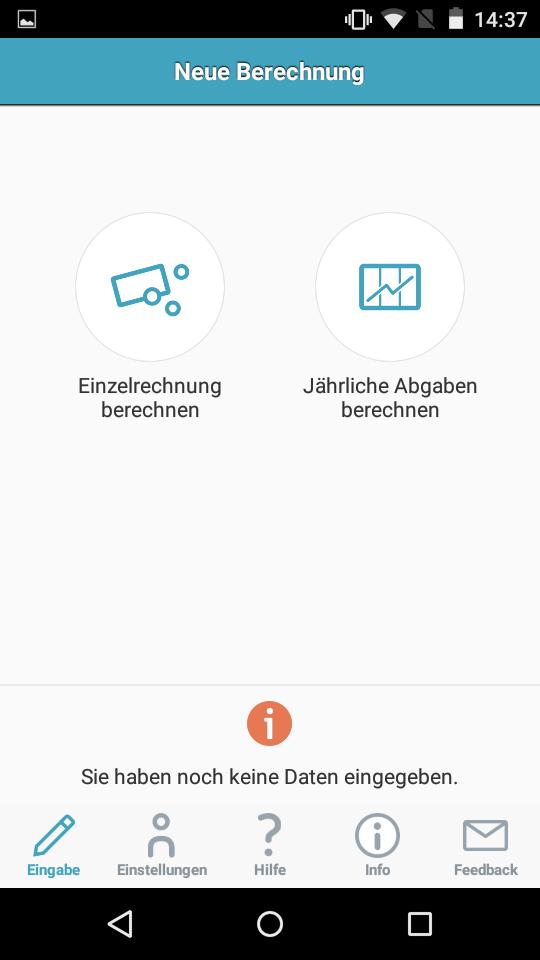

The SV- und Steuer-Rechner determines the social security contributions and income tax for the self-employed for the current year. The SVA contributions are calculated in a flat-rate form according to the GSVG and FSVG. This gives the self -employed a good overview of the social security contributions and income tax prescriptions to be expected in the current year. In addition to determining the total levies for the current year, the computer can also calculate the contributions that account for an individual invoice. In this way, the self -employed can quickly and quickly determine the amounts that should be put aside for the annual taxes per individual bill.

The insurance premiums are prescribed on the basis of a preliminary and a final basis for the contribution. Since the final contribution basis is based on the actual income, which typically only has been determined after the income tax assessment notice has been found, the following can result in a post -load or credit. Additions that may be expected in the following years are also determined by the contribution calculator.

The contribution app determines the contribution calculation based on the estimated annual sales minus the

-Expenses. In the calculation, complex tax and social security rules and laws are deliberately taken into account. This should make it easier to enter and ensure quick information acquisition in the form of an overview for young entrepreneurs, new founders, EPU and the self -employed in general.

The SV- und Steuer-Rechner is a joint initiative by the Federal Ministry of Digitization and Business Location (BMDW), Social Insurance of the Commercial Economy (SVA) and Chamber of Commerce (WKÖ).